Day 17/21

Can Bitcoin be banned by the government?

Short answer— no.

Long answer— technically. But ultimately, any ban is highly unlikely (and would not be in the interest of nation states). If a ban on Bitcoin were enacted somewhere, however, there would be no way to enforce said ban. In fact, many countries have already tried banning Bitcoin one way or another — Bolivia, Ecuador, Russia, India, China, etc. — just to name a few. But because of how Bitcoin is built — as a permissionless, pseudonymous medium of exchange — it’s about as effective as the government trying to ban free thought.

They might be able to ban it legally, but the only way they can stop free thought is by trying to manipulate public sentiment. We are no stranger to this phenomenon; you can probably think of a few scenarios where people appear to be tragically misinformed and brainwashed.

While I’m not of the cynical camp that everything is a psychological operation these days, the reality is that everything comes down to sales and marketing — especially for schools of thought.

Why would the government want to ban bitcoin?

Bitcoin works in parallel: Governments trying to hold onto central banking power are working on framing Bitcoin as an evil that works against the betterment of society.

To quote Senator Elizabeth Warren,

“cryptocurrencies undermine the government’s ability to maintain robust economic growth over time…Online theft, drug trafficking, ransom attacks and other illegal activity have all been made easier with crypto. Experts estimate that last year more than $412 million was paid to criminals in ransom through cryptocurrencies.”

And yet, she and other politicians alike fail to mention that between $800 billion and $2 trillion of fiat money is globally laundered each year, according to estimates from the United Nations —about 400 times more than in cryptocurrencies. In 2020, the criminal share of all cryptocurrency activity was just 0.34%.

What it seems to all come down to is control: The government currently regulates the economy by manipulating fiscal and monetary policy to foster economic growth. But to put our trust in the government is to put our trust in people who lack integrity, make decisions based on lobbying, and happily bail out big banks when they mess up without any care for what happens to the people (if you want an example, look up the Financial Crisis of 2008).

In China, Bitcoin has been “banned” countless times, one way or another. In general, China’s stance has been very anti-Bitcoin, since they want to create a digital yuan (a CBDC: central bank digital currency) that can be controlled and surveilled on. Bitcoin scares those with centralized control: What if the people choose something that we can no longer manipulate? It must be stopped.

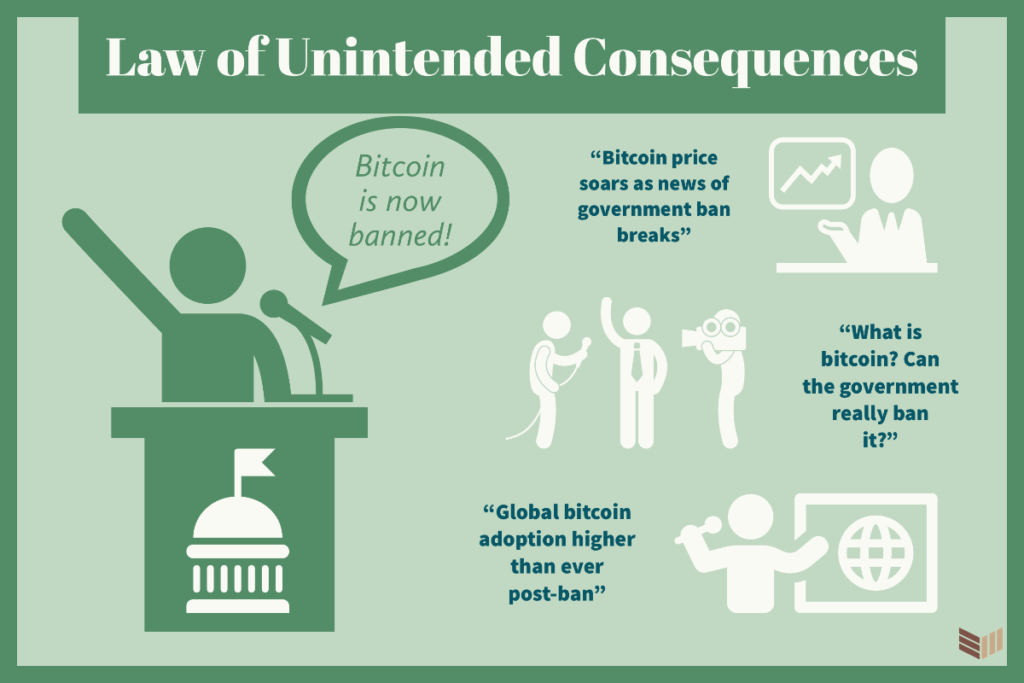

If the government tries to ban Bitcoin or cryptocurrencies, what will most likely result is a large pushback from the cryptocurrency community that attracts worldwide media attention — causing people who previously had never been interested in Bitcoin to now start looking into it.

The Concern for Mass Adoption

“Okay, so what if the government can’t stop Bitcoin? They can at least stop people from adopting it, right?”

The government may think they can slow down Bitcoin adoption, but their endeavors may not work out so well for them.

Allow me to introduce you to the law of unintended consequences. Some of my favorite examples include the Cobra effect and the Streisand effect (these stories are worth a quick search) — both are examples of situations where the exact opposite of what was intended ended up happening.

If Bitcoin does get “banned,” it will only end up being the biggest free marketing campaign that Bitcoin has ever had.

Can you see it now? The walls that they put up to hold us back will fall down. It’s a revolution against the existing, corrupt financial system that has harmed too many for far too long, and change is coming whether or not our leaders want to embrace it.

Copyright © 2022 BTC Media and posted in it’s entirety so you may learn what BTC is all about.