Day 11/21

Bitcoin is a novel invention that is hard for most people to wrap their heads around.

We can easily understand why gold and other precious metals have value. We understand that fiat money has value as assigned by our government. We understand that investing in a company is investing in its people and in their innovations.

But investing in bitcoin is just investing in…nothing that we can see, feel, or immediately understand. And this begs the question that comes to everyone’s mind when they first hear about bitcoin: What is its “intrinsic value?”

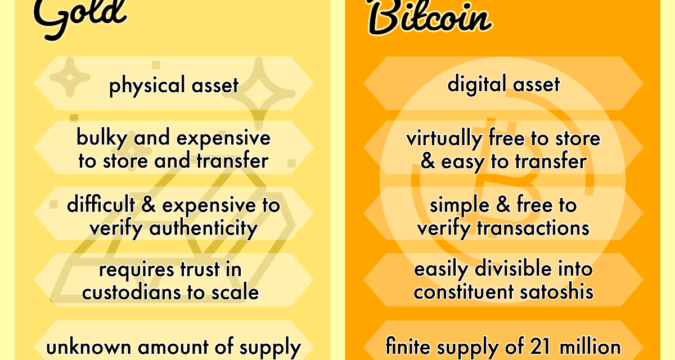

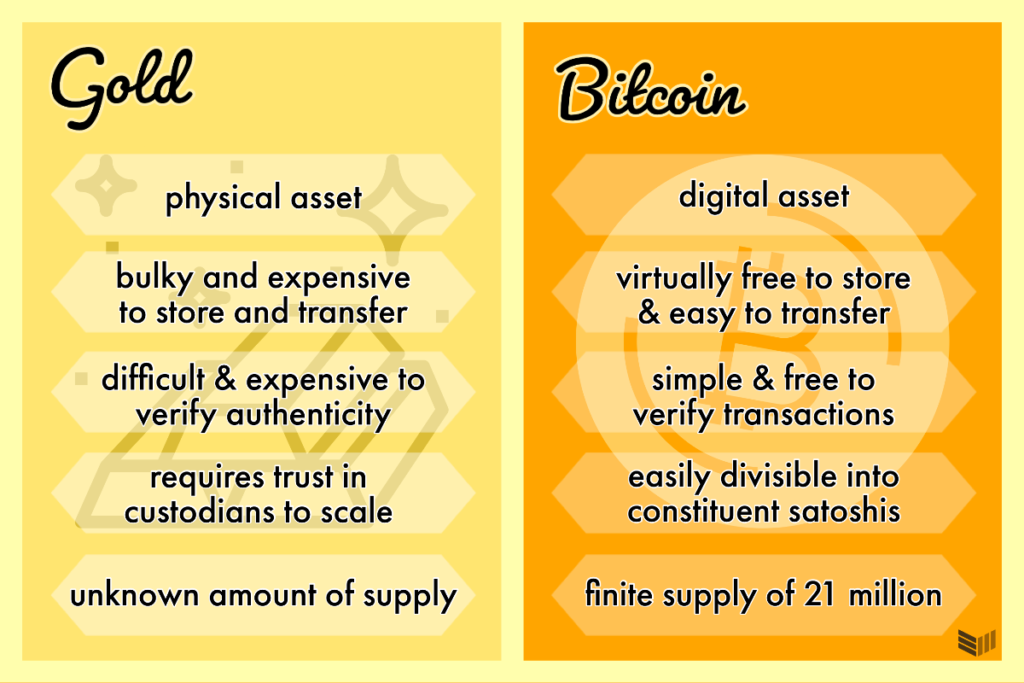

Bitcoin vs Gold

You might have heard the phrase, “bitcoin is digital gold.” Now, in the sense that it’s a store of value (and a better one than gold at that), this is true. However, at face value, gold is a tangible thing that can be seen, held, and used in jewelry and electronics. Bitcoin achieves…none of this. Yet, it is still a better store of value. Because while gold has the benefits of being seen and used as a physically tangible asset, these are the same things that make it a poorer store of value than bitcoin.

Let’s compare gold to bitcoin:

Shaving off pieces of your gold bar to pay for pumpkin spice lattes was never a viable option. Enter: fiat backed by gold, then eventually fiat backed by nothing but the government’s word.

What is the “intrinsic value” of the U.S. Dollar

That’s right, the dollar bills printed and distributed by the government aren’t backed by anything. Fiat money is just…paper with security tags on it? The only reason it has value is because the government says so, and this isn’t a good thing. Eventually, the cards will fall, and the housed trust that the government once held might someday render the dollar worthless.

This isn’t an unreasonable scare tactic, either. We’ve seen this play out in countries like Venezuela, where government corruption has rendered their national currency, the bolivar, effectively useless after suffering an inflation rate of nearly 54 million percent just a few years ago.

With bitcoin, nobody alone gets to dictate that there is value to it. Rather, the entirety of the Bitcoin network agrees to assign a certain monetary value to bitcoin, depending on its demand (which continues to rise over time). Not to mention, it does this without the threat of violence and power that all fiat currencies are upheld by. The value of the Bitcoin network and all the transactions that take place within it are secured by the blockchain, automatically managed without a middleman.

Do we need “intrinsic value”?

Unlike gold, bitcoin cannot be smelted to make jewelry or leafed to cover your gourmet soft serve. But bitcoin’s purpose isn’t to serve you in any physical way. It’s merely a medium of exchange, a store of wealth, and a peer-peer electronic cash that you can store access to in your memory.

And honestly, that’s a benefit over gold. Its value isn’t dependent on physical use cases — just purely predictable scarcity.

In a few emails, I’ll go over self-custody and what exactly that entails. But long story short, if you want to ensure security and ease of access, you can carry your bitcoin in a device no larger than a USB stick and keep a backup of it in your mind (pure magic). Or, you can buy heavy gold bars that are expensive to store and pray that we don’t start mining gold from asteroids and flooding the supply; if that were to actually happen, you wouldn’t be able to sell your gold fast enough.

Copyright © 2022 BTC Media and posted in it’s entirety so you may learn what BTC is all about.