Day 13/21

You have spent the last two weeks learning about how bitcoin works and why it works. For this final week, we’ll be discussing what bitcoin can do for you, but more importantly, what bitcoin can do for the world.

Perhaps you’re a seasoned bitcoin expert and you’ve got bitcoin wallets hidden all over the world, like this family that went all in on bitcoin when it was just $900.

Or, perhaps you’ve only just discovered what bitcoin is.

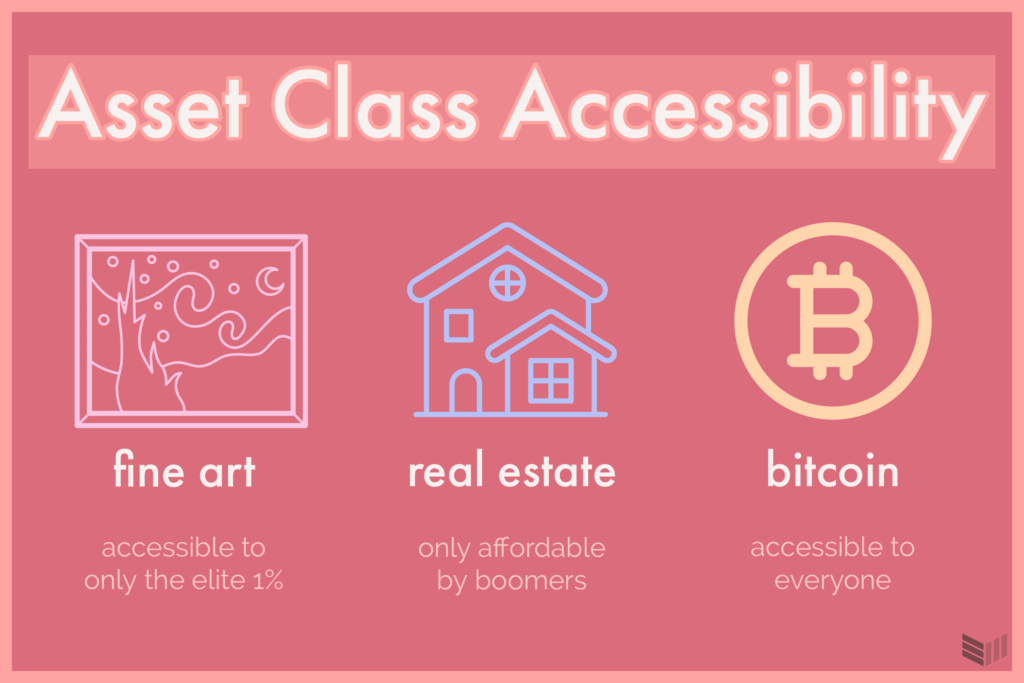

In any case, bitcoin is something that is for everyone, accessible to all — no matter your social or financial standing.

Many big banks and brokers are telling people that only their wealthiest, “accredited,” elite customers have access to this relatively new asset class. This is a ridiculous ploy by the legacy financial system that continues to unfairly deny equal participation in financial services that should be accessible to all. Fortunately, bitcoin requires no permission to participate.

What Are We Investing In Exactly?

At the moment, bitcoin is still viewed by some as a risky and volatile asset class that one invests in, hoping to make significant returns on. While there exists a culture within bitcoin that tells you to “buy and hold,” there are many people out there actively trading, holding short-term, or using bitcoin as a diversification asset tool as well.

While you should continue to do your own research and make the financial decisions that best suit you, if you’re ready to buy, sell, or transact bitcoin, I’ll break down how to do all of that step by step.

How To Buy Bitcoin

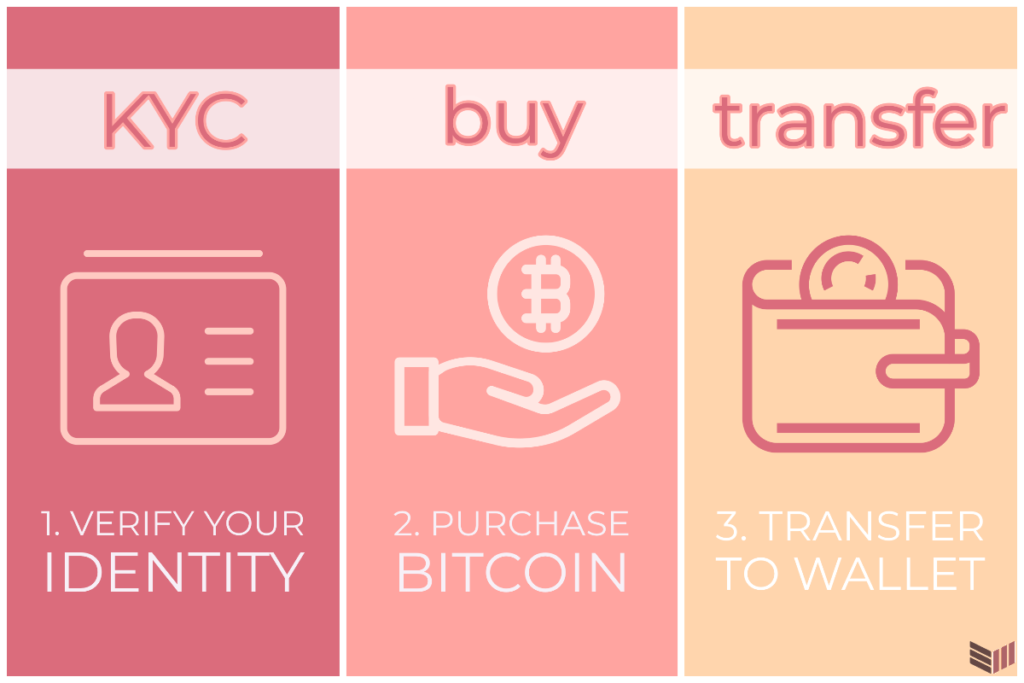

The easiest way to buy bitcoin is off of an exchange. You can use any exchange you’d like (such as Strike, and CashApp is great for beginners), but there are plenty of options to choose from. Keep in mind, however, when choosing an exchange, to make sure you choose one that allows you to transfer your bitcoin off of the exchange. This means you should not buy any bitcoin off of Robinhood or similar exchanges, since you would have to sell your bitcoin to take your money off of the exchange.

When you buy from an exchange, you are required to go through a process called KYC (Know Your Customer). This process requires your social security number, photos of your ID, and photos of your face to prove that you are you. Many bitcoiners are concerned with greater privacy and security than these exchanges can accommodate, so they choose to purchase “non-KYC” bitcoin from peers off of websites like Bisq — at a premium.

After you purchase bitcoin, you should send your bitcoin to a self-custody solution, which we’ll go over tomorrow. This is to protect your bitcoin just in case an exchange is hacked — while it’s more and more unlikely to happen now, this tragedy has unfolded multiple times before.

Reasons To Invest In Bitcoin

Okay, aside from being philosophically and economically sound, why should someone buy bitcoin? Buying bitcoin means storing wealth for yourself or your family — it’s not for anyone else’s benefit.

As inflation burns through working-class American stories and hyperinflation paints entire countries blue, it’s important to protect your future before it gets printed away. Creating generational wealth may have been easier for our parents and grandparents, but those who are growing up today see astronomically high tuition, real estate, and costs of living that aren’t adjacent to wage growth. By buying bitcoin, you’re shielding yourself and your family from the battle against currency debasement.

I’m still skeptical…

A big reason why many people continue to shy away from their first bitcoin investment is because bitcoiners are so deeply passionate about onboarding them (since they want to see you protect yourself), in the same way that your old high school classmate suddenly wants to be your best friend as they try to get you to sign up for their MLM.

While bitcoiners are purely intentioned, it often comes off as them shilling a Ponzi scheme. And although that’s the case with many altcoin cryptocurrencies (otherwise known as scams), nobody individually stands to benefit from an additional bitcoin user. Rather, the network expands and strengthens, and users are rewarded for their long-term investment holdings. So, negating any of this as financial advice, if you want to buy bitcoin, you should assess your own portfolio risk management and consider an allocation.

And although previous price performance doesn’t predict the future of how an asset or stock will perform, it might satisfy you to look over bitcoin’s performance in the last decade.

The soundest recommendation for those who buy bitcoin (and most other investment assets) is simply to just hold it long-term. Timing the market and trying to trade doesn’t usually fare well, and you’re better off just setting and forgetting it. Remember this: play stupid games, win stupid prizes.

Investment Takeaways

Disclaimer: none of this is financial advice. I personally own bitcoin and I believe in its long-term success. However, with any investment, it’s important to do your own due diligence and understand exactly what you’re buying. With that said, many financial advisors today would tell you it’s considerably a good idea to allocate at least a small non-zero percentage of your investments into bitcoin. This way, you’re leveraging a low risk with a potential of high future returns.

Copyright © 2022 BTC Media and posted in it’s entirety so you may learn what BTC is all about.