Day 19/21

Bitcoin is the original cryptocurrency. Since its genesis in 2009, countless DeFi projects and altcoins have popped up; from Dogecoin to ETH, there’s undoubtedly a huge market for alternatives to bitcoin.

People love how applications of different altcoins have use cases beyond just bitcoin’s main selling point as a store of value. Several new altcoin projects built on Ethereum or forked off of existing cryptocurrencies have improved privacy, increased scalability, enabled smart contract capabilities, and much more. Arguably, there’s a case for choosing other cryptocurrencies over Bitcoin; Bitcoin’s technology is far from perfect, and new developments are slow to implement.

Yet, it’s this “hard to change” feature that makes bitcoin so special — and that’s due to the vast size of the Bitcoin network.

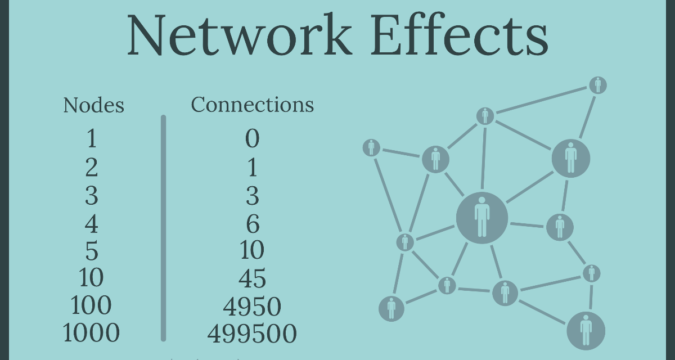

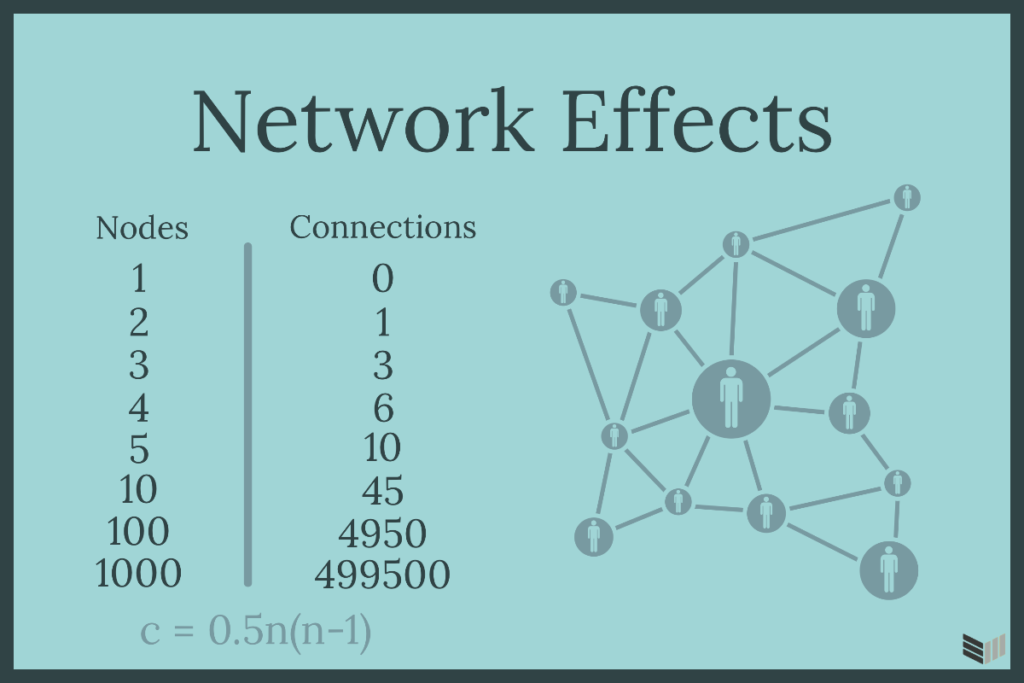

Network effects are a special phenomenon because with each additional user, there isn’t just a linear growth in network dominance — there’s an exponential one. Think about it this way: If Nick and Alex are part of the network, then they make one connection with each other. If Jeremy comes into the picture, the three of them can now make three connections in total. Now add Nicole, and we have six connections. Here’s what the numbers look like if we keep adding people to the network:

This is how Facebook, Amazon, and Bitcoin have each dominated their respective industries. Facebook, one of the biggest companies and social networking sites alive today, was once just a competitor in a rapidly growing space. Before Facebook’s dominance, MySpace had held the title for #1 social networking site. As Facebook grew and honed in on its mobile app development, it became a far better product than MySpace — arguably, a 10x better product — leading to its status as social media king. This is due to a concept known as the “10x Rule,” where a new competitor must be magnitudes better than the incumbent in order to take over the incumbent network.

In the world of cryptocurrency, no altcoin will come close to being 10x better than bitcoin. That’s because Bitcoin’s security and network dominance strengthen exponentially: As more nodes join the network, Bitcoin becomes more secure, and it becomes increasingly more impossible for a new crypto to dominate.

Bitcoin Needs No Campaign

The craziest thing is that bitcoin needs no marketing — it has achieved market dominance all on its own. Many altcoins require that sales push for even a minimal market cap. Take a look at the number of celebrities promoting altcoins such as Tron, and you’ll realize how desperate these very centralized cryptocurrencies are.

The concept of the dominating network effect was what ultimately convinced me of Bitcoin’s success over all other cryptocurrencies. While we can deeply study technical intricacies and debate tokenomics all day long, it ultimately doesn’t matter — Bitcoin has already won because it has network dominance that continues to grow.

ETH, Doge, and any other cryptocurrency will never be able to surpass bitcoin (despite what many people might try to tell you) — no matter how “improved” their technologies claim to be. Simply put, if these altcoins can’t even match up to Bitcoin’s entrenched strength in decentralization and security, how can they ever contend to dominate the network?

Copyright © 2022 BTC Media and posted in it’s entirety so you may learn what BTC is all about.