Day 9/21

A fork in the road.

2017: Civil War

We’re starting today off with a small history lesson. While it seems like eons ago already, a fairly recent civil war emerged between two sides of the bitcoin community in 2017 — changing everything.

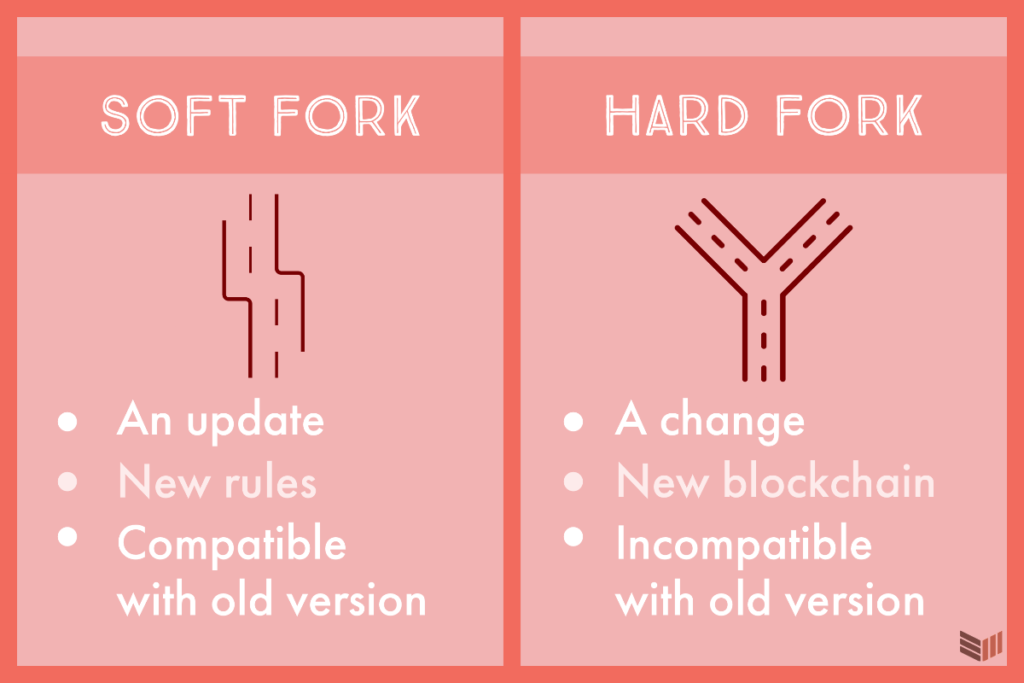

By now, you’re familiar with bitcoin, or what we know as BTC (alternatively, XBT on some exchanges). In 2017, Bitcoin Cash (BCH) emerged as the result of a “hard fork” that transpired. Hard forks are pretty intuitively explained by the graphic above, but in essence, when some people want to change the rules of a blockchain network (without full consensus approval), they break off into a separate blockchain completely to change their network’s rules. Kind of like a divorce, if you will.

This is exactly what happened with BTC and BCH. On August 1, 2017, everyone who held bitcoin now held an equal amount of bitcoin cash. The community soon decided that BTC would be the winner (as proven by the price difference and hash-rate today). But why the contention in the first place?

The Scaling Problem

If you ask many bitcoiners today what they think about bitcoin’s scaling issues, they will chuckle and tell you that bitcoin doesn’t have a scaling problem. However arguably problematic the scaling issue is, the underlying truth is still the same: bitcoin cannot scale on its own. It needs solutions if the world is to adopt it.

Tomorrow I’ll go over layered solutions for scaling bitcoin for use as a peer-to-peer cash, but today we’ll be covering how bitcoin cash attempts to natively scale bitcoin — on the blockchain.

The Blocksize Debate

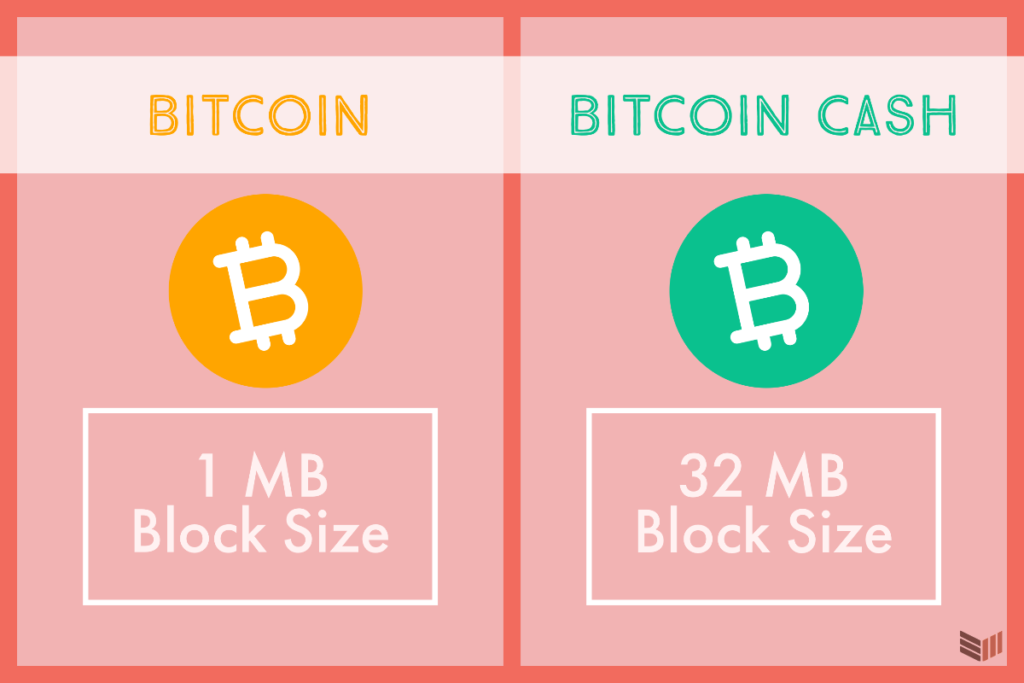

Early adopters of bitcoin debated over how to scale bitcoin. While some argued that scaling should be solved with patiently developed off-chain solutions, others pushed for increasing bitcoin’s 1MB block-size, so as to not drive away new adopters when blocks became increasingly congested with transactions.

At first glance, it seems like a good idea to increase block size capacity and lower transaction fees for users. But going down this route would require more expensive and sophisticated hardware, making it less accessible for individual users (as opposed to massive corporations) to be able to verify blocks with their own nodes. As block size increases, it becomes more difficult for full nodes to efficiently validate blocks, thus increasing the barrier to entry for running nodes and making bitcoin less decentralized.

Bitcoin must scale, but it needs to do so without compromising security and decentralization.

Because of this contention in the bitcoin community, those who pushed for a larger block-size launched bitcoin cash by creating a bitcoin hard fork that would increase the block-size from 1MB to 32MB capacity.

Unfortunately for the bitcoin cash community, the last few years have phased it out of relevance. While there are still many proponents of bitcoin cash today, the general community has dictated bitcoin the winner, as proven by its market dominance and the mining power dedicated to the Bitcoin network.

Other Types of Forks

Many more hard forks have come out of different cryptocurrencies over the years. One of the most popular forks of bitcoin is Litecoin (LTC), and a prominent fork of bitcoin cash is Bitcoin SV (BSV).

Copyright © 2022 BTC Media and posted in it’s entirety so you may learn what BTC is all about.