Day 4/21

Imagine central banking as this guy:

The Monopoly Man represents the central bank.

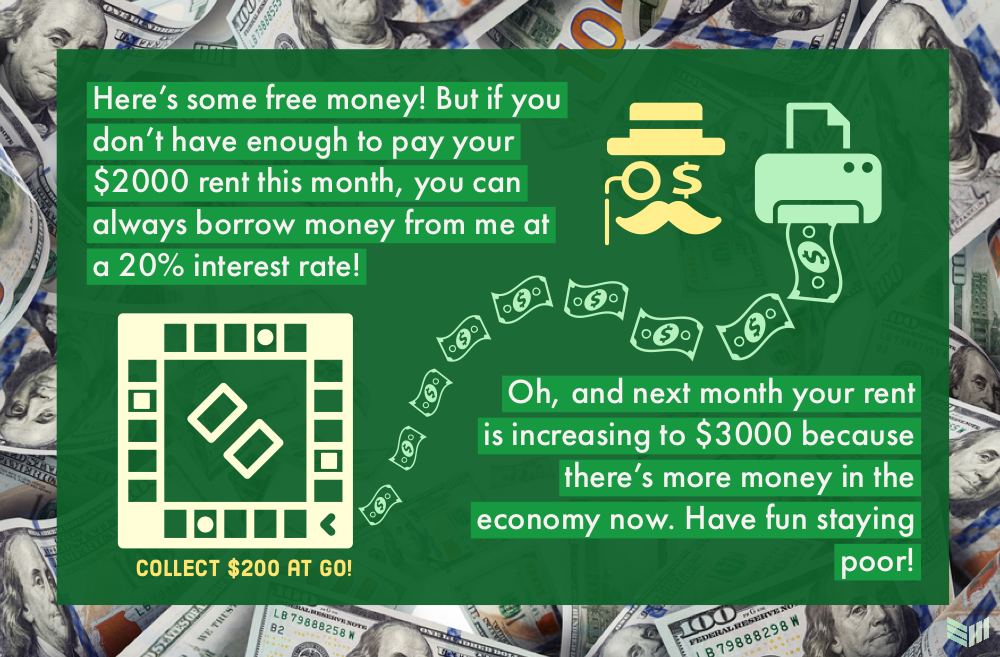

On the first few passes around the Monopoly board, you have the opportunity to buy real estate and other commodities. The market is open, prices are affordable, and competition is low. Sometimes, you get unlucky and have to pay a surprise fine or a hefty tax. But, such is life.

He allows you to collect $200 when you pass GO, just because he’s a nice guy. Perhaps you’ve now replenished some of your savings, so you return back to the board and take another pass around.

After a few rounds of properties purchased, rents paid out to owners, and collecting free money at GO, a certain dreadful doom starts to set in — you pray you don’t land on someone’s duplex, or even worse, their hotel. With each pass around the board, you’re still collecting your $200. Not to rain on your parade, but $200 doesn’t mean much when your savings is wiped out and rent seems to double each turn you take.

While this is an exaggerated version of the game of life, the basic principles remain: Those who have invested in assets (like real estate or stocks) see their net worth appreciate; those who owe debts and have little to no assets continue to see their savings wiped out. Their purchasing power weakens, commodities and assets become more expensive, and no amount of government handouts can save them.

In fact, the “free money” comes back to bite them even harder the next round. While the rich see their assets inflate in price because more money is introduced into the game, the poor see their savings debased because the necessities they could once afford (like rent) become unbearably expensive.

This is a result of inflation: where the government prints money on a whim to fuel the economy. But in the end, the rich only get richer and the price of goods become more expensive, thus trapping people in a cycle of poverty — even though they may collect $200 at GO.

The government is allowed to inflate the monetary supply whenever they want. They want you to think everything’s under control — and it is, literally. Therein lies the issue: They’ll stab you in the back while shaking your hand.

With Bitcoin, however, nobody is in control. Bitcoin’s supply is capped at 21 million, whereas fiat dollars can be boundlessly printed.

The result of bitcoin’s supply cap is scarcity. As demand for bitcoin rises, so will its price, and thus, its purchasing power as well.

The Magic Number

Nobody knows where the 21 million bitcoin cap comes from; this is likely just an arbitrarily chosen number. However, what’s important is that this number can’t be changed — ever. It’s baked into the code, and in order to change the software to increase this supply cap, everyone would have to agree. However, people don’t want the value of their bitcoin to decrease, so there’s no way we would reach the consensus required to increase this number.

Obviously, there are more than 21 million people in the world; this means that not everyone can own a whole bitcoin. In fact, there are twice as many current millionaires as there are bitcoin in the world; this should give you a sense of the future value of bitcoin as adoption continues to grow.

Even though bitcoin supply is capped, each bitcoin can be split into “satoshis,” kind of like how dollars can be split into cents. Each bitcoin contains 100 million satoshis, and so there are 2.1 quadrillion satoshis in total.

Supply and Demand

Currently, not all 21 million bitcoin are up for grabs yet — I’ll go over this later when I talk about how new bitcoin is mined. But as we slowly increase the supply until no more new bitcoin is available, demand and adoption will determine the price of bitcoin.

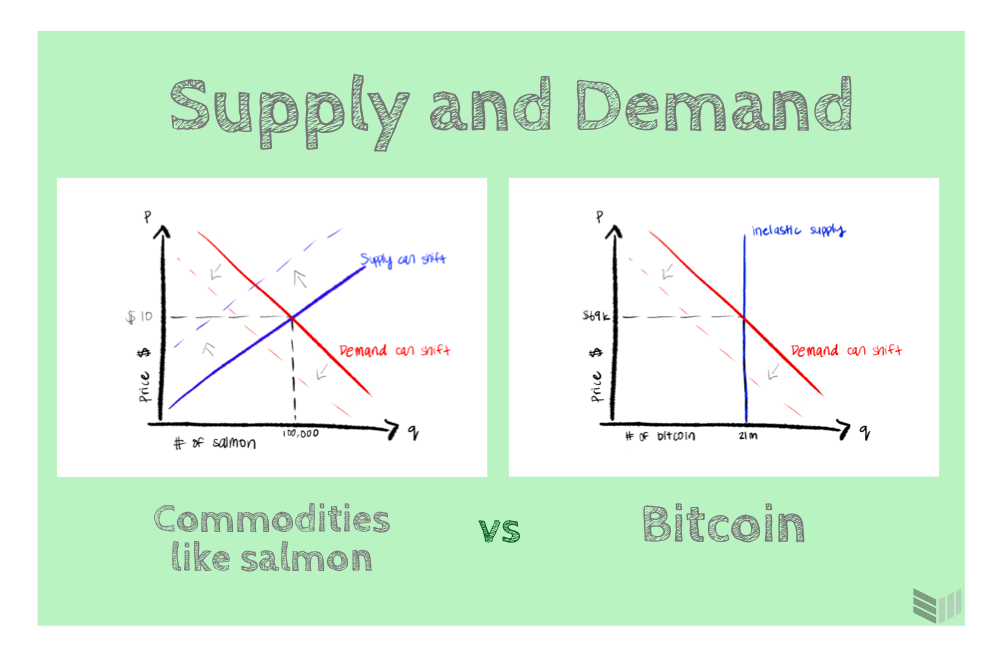

In your basic high school economics class, you probably learned about a microeconomic concept called the supply and demand curve. Although no economic model is perfectly representative of a real-world scenario, bitcoin’s curve is a little bit special.

Let’s take a look at this supply and demand chart comparing salmon and bitcoin:

While the supply of salmon is not necessarily fixed because we can farm fish and source fish from different areas of the world, the supply of bitcoin is capped strictly to 21 million — this is what we call a perfectly inelastic supply.

As a result, this means that only shifts in demand affect price; as demand continues to increase with institutional adoption and countries like El Salvador declaring bitcoin legal tender, there’s only one place bitcoin price is headed: the moon. Short term though, demand can dip and the price will fall with it.

Although we’re still far from using bitcoin in the way that we use dollars to purchase goods, what we can do is hold our wealth in bitcoin. As the purchasing power of the dollar weakens due to ever-inflating supply, bitcoin supply remains immutable, and so the purchasing power of bitcoin should continue to rise over time — forever.

Copyright © 2022 BTC Media and posted in it’s entirety so you may learn what BTC is all about.